Portfolio: J-Star and Japan Hospice Holdings

In 2014 J-Star bet on a pair of pioneering companies in Japan’s hospice care market. Now the resulting platform is set to dominate the still-nascent industry with high standards for care and patient dignity

Japan's universal healthcare system has long been one of the country's proudest assets, with all citizens guaranteed coverage through employer or government-sponsored insurance plans at affordable rates. As a result of this easy access to care, Japan led the world in average life expectancy at birth and had one of the lowest infant mortality rates in 2015, according to the World Health Organization.

But these undeniable achievements in healthcare have also created a major problem, as an increasingly older population places growing demands on the hospital network. The situation is particularly acute with end of life care, which the majority of hospitals are not equipped to deliver at the level that patients and families expect.

"The average life expectancy in Japan is now over 80, so people are enjoying much longer lives," says Satoru Arakawa, a partner at Japanese mid-market GP J-Star. "But for the post-Second World War generation there is a lot more emphasis on the quality of life rather than the longevity, so people now demand more and more quality services and the hospitals cannot provide them."

J-Star believes the end of life challenge can deliver handsome rewards for those that find the right solution – and it thinks it has done so with Japan Hospice Holdings, one of the country's first dedicated hospice care providers. By consolidating a handful of independent operators J-Star has made Japan Hospice into the dominant player in a nascent area, and it believes the company is on track to maintain its leadership as the market continues to develop.

Getting older

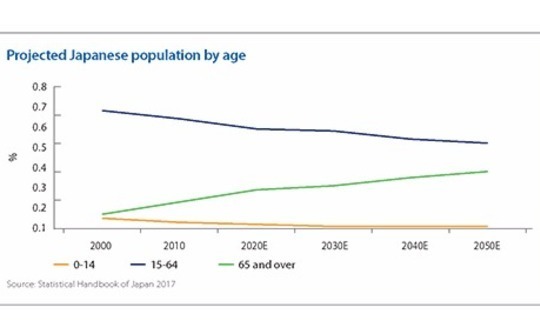

Japan's demographic pressures have been building for some time now. According to government statistics, the share of the population aged 65 and older climbed from 17% to 27% between 2000 and 2015, and is expected to reach more than a third by 2040. Meanwhile, those aged 0-14 are expected to account for 11% of the population by 2040, compared to 15% in 2000, and those aged 15-64 will fall from 68% to 54% over the same period.

The social challenges created by these shifts are the subject of much debate, such as a significant labor shortage and the burdens of elderly citizens' medical needs. But for all the attention that Japan has paid to when its citizens die, where they die has historically been overlooked, with most people continuing to trust that the public health system will continue to care for the elderly until they have passed away. It is an assumption that has become increasingly unrealistic.

"At the moment most people die in hospital, which means that we don't have a mature hospice culture in Japan," says Shinichiro Kato, CFO of Japan Hospice. "But with the growth of the elderly population, the government is trying to keep hospital costs from increasing. This will lead to hospitals being overbooked and having to make choices: for example, late-stage cancer patients being sent home to make room for patients with a better chance of recovery."

Japanese people had come to accept this as a normal state of affairs, but J-Star knew the government was poised to enact major healthcare reforms that would require hospitals to shift their focus away from end of life cases. This would likely create a surge in demand for locations that can offer the high-quality, respectful care that elderly patients' families are for the most part no longer equipped to provide at home.

"The number of people who die each year is going to keep increasing, so we need a place to care for these people," says Arakawa. "There are many senior residential homes and long-term care providers in Japan, but many of the existing service providers did not have the training to care for the terminally ill people. So that was the opportunity we saw."

Investment opportunities were limited as the GP began its search since up to this point hospice care had not caught on in Japan. But there were a few exceptions, most prominently Nagoya-based Nurse Call and Kairos, which operated two home nursing care providers and a hospice facility in the Kanagawa region.

J-Star would have considered either of these companies a good catch; as it turned out it had an opportunity to acquire both, thanks to the impending retirement of Nurse Call founder Toyomi Yoshida. Yoshida was considered the creator of Japan's private hospice care model and was a mentor to Tadashi Takahashi, the founder of Kairos.

J-Star was already well acquainted with Takahashi, having built a rapport with him when he was the CEO of a home nursing care provider that the firm was considering buying. When J-Star heard that Yoshida was looking to exit her business after 12 years, it suggested that Takahashi succeed her and merge the two companies. J-Star supported the transaction financially.

A brand apart

Japan Hospice is now in the process of filling the niche currently occupied primarily by hospitals, but J-Star wants to position the company as more than just an alternative to existing facilities. With a field largely free of serious competitors for the moment, Japan Hospice has the opportunity to create an association with its brand in customers' minds; hopefully, Japanese families will come to see the company as synonymous with the concept of hospice care itself.

This goal applies to staffing as well. While trained medical staff are not hard to find in Japan, most trained nurses are not familiar with the concept of palliative care and may be hesitant to come onboard. Before her departure Yoshida, a trained nurse and charismatic personality, played a major role in attracting new staff to Nurse Call. Takahashi and J-Star knew they could not replace her unique strengths when it came to recruiting, but felt that a similar approach on a lower level might still pay off.

"Because the Japanese government has stopped growing the hospitals, many skilled nurses now need to find a new job in other areas," says Arakawa. "One of the first things we do is to headhunt the head nurse in a hospital. Since she has some influence over other nurses, she can help to attract many nurses from other hospitals to work for our facilities."

The company is also building its organizational capacity for recruitment and increasing its presence at job fairs, academic conferences and other events aimed at the medical industry. It wants to educate the wider market about the hospice model in order to supplement the personality-driven side of its hiring practices. Through this strategy, Japan Hospice hopes to grow the pool of potential employees as it opens new facilities.

So far Japan Hospice's growth strategy has focused mainly on Nagoya and Kanto, the pre-merger home cities of Nurse Call and Kairos. Greenfield expansion is the priority, due to a lack of existing hospice providers that are suitable for a takeover. However, the company also pursues acquisitions that facilitate entry into markets outside of its home territories. The purchase of Osaka-based Platia and Tokyo-based Live Cross were the results of this strategy. Both companies run a variety of services but will add hospice care to their offerings.

Since J-Star's investment, the company has grown relatively quickly, expanding from three facilities initially to 10 after the Live Cross acquisition. Starting this year Japan Hospice plans to slow down its greenfield expansion to one facility per year so as not to outrun its cash reserves.

Maintaining quality of service and facilities is also a major part of the company's growth plans. Potential patients and their families need to understand that palliative care is not just about providing better food, better service, or more caregivers than hospitals – rather, the company aims to make residents' final days comfortable and dignified in a way that simply is not possible in the restrictive environment of a hospital ward.

Residents have a greater degree of personal freedom than hospital patients – they are allowed to drink or smoke if they want, and can leave the facility or socialize as they please. The construction of the facility is also designed to emphasize the respect to which residents and their families are entitled.

"Mr. Takahashi was originally an architect, so he really cares about the buildings, the rooms and the atmosphere of the facilities," says Arawaka. "He even developed a room where the family can stay alongside the bed, so the patient can live with his family as long as possible."

Barriers to entry

Though demand for hospice care is expected to keep rising as the elderly population grows and the government keeps hospital space steady, Japan Hospice has yet to see any significant competition arise. The number of home nursing care businesses has expanded, but the market continues to lack organized palliative care facility businesses other than Japan Hospice itself.

The company attributes this shortfall to several reasons. For one, while there are independent hospices run by capable medical professionals, these owners typically lack the managerial skill to expand beyond a single location. As such, they are unlikely to mount a serious challenge to Japan Hospice with its 10 facilities in four cities.

Another factor is the investment in terms of time and effort needed to establish credibility in the country's wider healthcare space. Few competitors can match the reputation of Nurse Call, founded in 2002 by a respected nurse, and the bonds that it has created with hospitals in its markets.

"Our business involves treating patients with high medical needs, and that's why we need a trusting relationship with a hospital," says Japan Hospice's Kato. "Without this kind of relationship, they wouldn't want to send the patients to the facility; they don't know whether we have enough skilled nurses or not. It takes two to three years to build that kind of relationship."

By next year J-Star expects Japan Hospice's facilities to be fully occupied, and it has received inbound inquiries from landowners and real estate developers interested in providing space and resources for further expansion. The company is also investing internally in training the next generation of leaders to take over from the founders and move it to the next level.

With the stage set for future growth, J-Star is making plans for its exit, which it expects to come via an IPO in the next few years, once the company has demonstrated consistently strong financial performance. While offerings by aged care providers have faltered in other markets, the firm believes Japanese investors will be attracted by the company's stability and its leadership position. The social utility of the underlying business is also expected to be a major factor in establishing investor interest.

"Caring for seniors is a big social issue, and I think this business model will attract many individual investors along with institutional investors," says Arakawa. "Also, this is a great business, in a highly growing industry in Japan. We might not expect high double-digit growth, but I think this company has a clearly recognized potential to grow."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.