Japan fundraising: Middle market momentum

Japan’s buyout space has been thrust into the spotlight following a flurry of fundraising activity by domestic private equity firms. Can the middle market retain its sweet spot status?

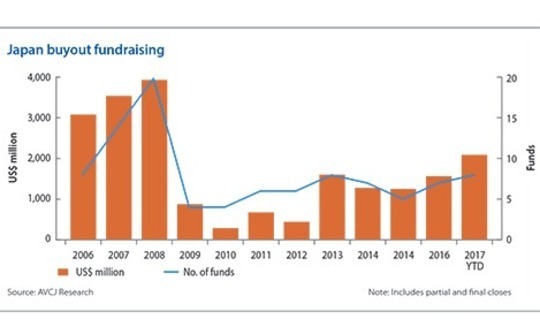

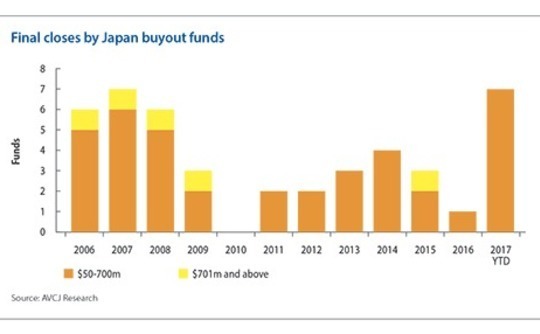

April heralds the start of a new financial year in Japan, and for several local GPs on the fundraising trail it could be seen to mark when the country completed its transition from a backwater of Asian private equity to the latest in-demand market. Seven final closes – all at their hard caps – have been announced so far this year in the buyout space, matching the 2007 total, and six of them fell in April.

Advantage Partners, CLSA Capital Partners (CLSA CP), Integral Group, J-Star, Polaris Capital Group, and Tokio Marine Capital; the timing is no coincidence. Various domestic LPs have taken the opportunity to push their commitments to mid-market managers into the 2018 financial year – either because they have exhausted the previous year's allocation or because they didn't have an allocation to private equity at all and are now looking to play catch up.

"Some groups made lots of investments in the last fiscal year so they waited for allocations to fall in the new fiscal year. As a result, GPs extended final closings to April," says Kazushige Kobayashi, managing director and head of Asia investment management at Capital Dynamics. "We are seeing very strong demand on the LP side, especially among Japanese groups."

Over the three years to 2008, a total of 42 funds raised a combined $10.6 billion. Approximately half that total went into three funds, raised by The Carlyle Group, Advantage Partners and Unison Capital, respectively. These highs are in no danger of being eclipsed.

Of the six final closes announced in April, no single fund is more than JPY75 billion ($662 million) in size. Advantage closed its fifth vehicle at JPY60 billion, larger than the JPY20 billion bridge fund raised in 2013 that enabled the GP to prove its mid-market credentials, but far removed from the JPY215 billion raised for Fund IV in 2007. According to Richard Folsom, Advantage's co-founder, some LPs that withdrew from domestic PE after the crisis are reengaging.

"About 65% of the new fund is Japanese capital, somewhat more than Fund IV, which was much larger. It came with greater expectation for more large-size deals in the 2007-2008 timeframe but that didn't play out, and the most consistent and attractive part of the market since then has been the small and mid-market space," he says. "Many insurance companies, pension funds and trust banks that invested in 2007-2008 were then sidelined for different reasons. Now they are beginning to come back."

This view is shared by Tsuyoshi Yamazaki, a director with Integral, who notes that the most striking difference between the firm's Fund II (JPY44.2 billion) and Fund III (JPY73 billion) LP bases is participation from large institutional players such as insurers.

"When we were raising Fund II those names were investing in global funds but they didn't do mid-market Japanese funds," he says. "A number of mid-size GPs got hit as a result of the global financial crisis and so they held off committing to those funds. But in the last few years, the performance of mid-cap Japan-focused funds, including ourselves, has been good."

Bucks from banks

Integral was already seeing demand from regional banks when it closed its second fund in late 2014, but for many Japanese GPs increased appetite for exposure from financial institutions in general has been critical to these relatively rapid fundraises. Negative interest rates are clearly a motivating factor: There is a cost to holding residual cash so they are incentivized to deploy capital wherever they can.

Japan's three mega banks are said to be committing larger amounts to the asset class, writing big checks for individual managers or contributing smaller amounts to each one as a relationship-building exercise intended to generate downstream transaction financing work. And where they go, clusters of the nation's approximately 120 regional lenders often follow.

Tokio Marine raised JPY23.3 billion for its fourth fund, which closed in 2013, receiving commitments from 18 LPs. Fundraising for the fifth vehicle was completed in six months. A total of 34 investors – all domestic – contributed JPY51.7 billion between them, and one third of that came from 17 regional banks.

At most regional banks, PE falls under the remit of the general investment team. Tuck Furuya, co-founder of local placement agent Ark Totan Alternative, describes an investment professional's day as working on listed equities until the public markets close at 3 p.m. and then switching focus to alternatives. However, he is convinced they are making more informed decisions than in the past and want to be long-term participants in the asset class.

"They invested in private equity 10 years ago without really understanding the risk or performing due diligence. It was more relationship-driven and they lost money," Furuya explains. "This time around they are being more careful – they have created budgets for private equity and understand the importance of vintage diversification. These budgets will fluctuate but it's not a one-time event, they are here to stay."

Not everyone is so optimistic. If there are long-term fundamental drivers behind the rising tide of insurance and pension fund money expected to enter the asset class, regional banks are seen as more opportunistic. Kobayashi of Capital Dynamics adds that staff are rotated through positions every few years, making it hard to build experienced teams, and so investments still tend to be largely relationship-driven.

Of the six final closes from April, only J-Star and CLSA CP received a clear majority of their commitments from international investors. The domestic LP base varies by manager, but one of the questions commonly asked about funds with a heavy reliance on local investors – and particularly a certain type of local investor – is how many of those backers are likely to be willing and able to re-up next time around.

"GPs looking to tap international investors will need to put the work in to get their materials adequately translated, and into a format required by international investors. For a broad-based international fundraise, you will also need to have the appropriate offshore fund structure in place," says Ian Bell, managing director at placement agent Evercore. "For GPs willing to take those steps, the reward will be an opportunity to strategically diversify their LP base. While the current appetite from domestic LPs in Japan for private equity is buoyant, we've seen situations where there have been wholesale shifts in demand from a domestic LP base."

The parallel structure comprising a Japan limited partnership and a Cayman Islands feeder vehicle for foreign investors helps minimize tax leakage but costly to set up and burdensome to manage. Indeed, one of the reasons CLSA CP has the lowest share of Japanese investors out of the six final closes – at 25% – is because its funds uses a Cayman limited partnership and all the documentation is in English.

In each of the firm's first two Japan funds there was only one local LP. That number has risen to around 10 in the latest vehicle, which closed at $400 million, and the largest contribution came from the mega banks. There is only one regional bank.

Pros and cons

For foreign investors, Japan appeals because the risk-return profile is different from emerging economies in the region. And the middle market has established itself as the preeminent space – for foreign and domestic LPs alike – thanks to three driving factors: relatively low entry valuations of 5-7x EBITDA that offer room for multiple expansion; the availability of leveraged financing, with GPs able to buy at 7x EBITDA and get 4x of debt even for deals of $50-100 million; and operational improvement.

"Returns have been 60%-plus driven by improvement in EBITDA, and it's not just cost reductions and improved margins. Japan might be one of the slowest growing economies in Asia, but there are lots of opportunities for double-digit top-line growth in various sectors and situations," says Advantage's Folsom. "Leverage plays a role, and there is readily available and cheap debt, but growth and profitability are the largest driver of returns."

Founder-owner succession situations dominate deal flow in this segment of the market and PE firms have shown their ability to add value by professionalizing management and then reposition businesses to achieve greater scale. Will the effectiveness of this strategy – often characterized by proprietary transactions – be impacted by a host of new funds coming online?

The private equity firms themselves, perhaps predictably, reply in the negative. First, the number of GPs pursuing mid-market buyouts has not changed much from the last cycle. Second, fund sizes may have increased, but not substantially, and the growth is commensurate with the broadening of the investment opportunity as more company founders are willing to do business with private equity.

For some, this last point is difficult to swallow. Excluding Advantage but including CITIC Capital, which closed its most recent Japan fund in February, the average jump in fund size from the previous vintage among the six is above 80%. Tokio Marine's fund represents the extreme end of the scale, coming in at more than twice the size of its predecessor. Certain GPs may have undershot their targets in 2012-2014, but Ark Totan's Furuya asks whether the investment opportunity has really changed that much.

"I feel like the GPs in Japan are raising too much money," he says, without referring specifically to any of the above managers. "A lot of people understand that fundraising is very painful. This time it was not as difficult as they predicted and because they don't know if the money will be there next time around, the impression I get is they want to gather everything they can right now."

It is unclear how all this will play out. The increases in fund size could be justified by the scope of the opportunity and domestic LPs may prove they have staying power, ensuring Japan's middle market doesn't lack capital or places to deploy it. But anecdotal evidence suggests the market is not as proprietary as it once was and entry multiples are rising, which means PE firms have to make their value creation strategies work.

"The number of succession-related deals has been growing steadily and I feel the anti-PE sentiment among owners has almost been erased," says Megumi Kiyozuka, managing director at CLSA CP. "Having said that, there is more dry powder in the market so this investment cycle is likely to be challenging. If you forget about discipline and if you don't have enough capabilities to add value to portfolio companies, you might be in a difficult position."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.